When it comes to buying trucks and equipment, the majority of owner-operators prefer the used market, according to Overdrive’s Truck Purchase and Lease Survey. Out of all of the survey’s respondents, 56% of them reported buying used trucks, 32% bought new, and less than 10% leased their trucks or equipment.

However, while purchasing used trucks and equipment is preferred among owner-operators, finding said trucks and equipment at a fair price is more challenging than ever. Thanks to the COVID-19 pandemic and the delays in production, brought on by component shortages, many owner-operators are forced to consider other purchasing options.

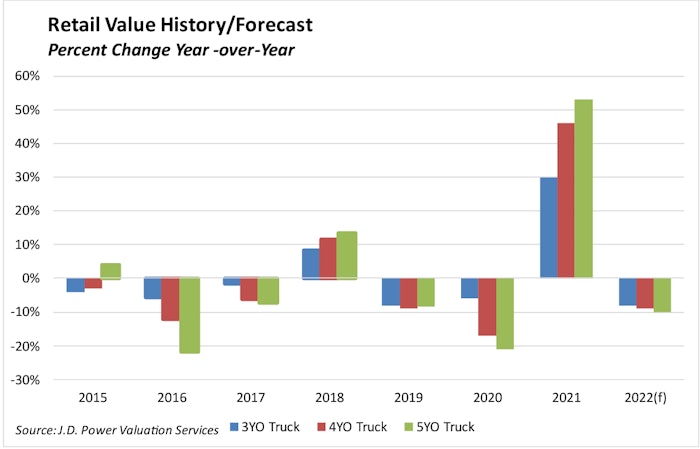

Unfortunately, truck dealerships aren’t receiving much in the way of new inventory. In 2021, new trucks were being ordered, but they wouldn’t arrive until December. And, to top it off, fewer trade-ins are making their way onto the lots, thus pushing prices of used trucks through the roof. In 2021, used trucks retailed for the most they ever have in the modern era. For example, a used sleeper, with over 450,000 miles on it, sold for a little over $90,000. This price was approximately 85.5% higher than the previous year. And while some industry professionals anticipated a slow descent in used truck prices in 2022, others caved to the pressure of the market and sold off their fleets for substantial amounts of money.

Are higher lending rates to come?

Industry experts also predict that new truck production will eventually catch up and balance out. Once trucks start rolling off of assembly lines, used-truck buyers will want to consider the potential financing impact new truck production could have on trade-ins with higher mileage than normal.

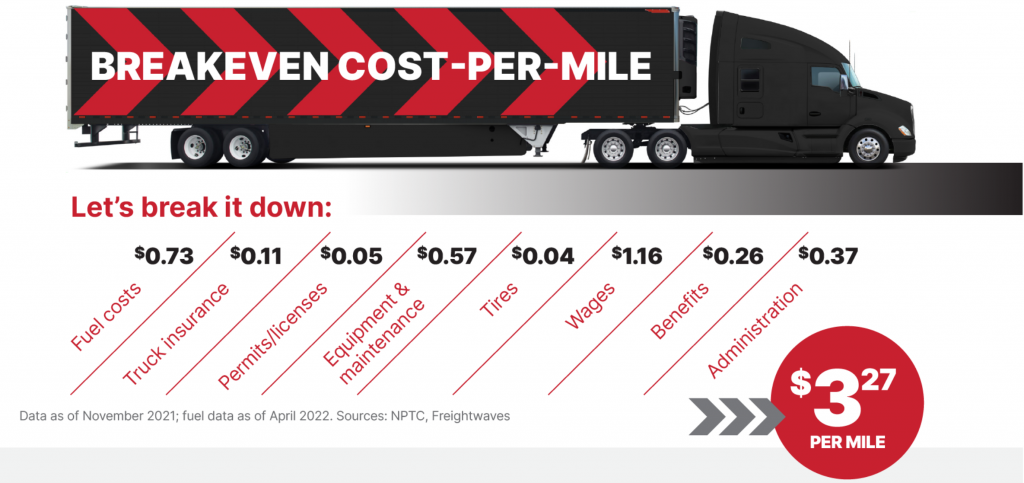

Financing a used truck is already a challenge due to the higher risk lenders take since used trucks typically face engine problems. When the trade-ins that drivers clung onto in lieu of new inventory arrive at dealerships, they will arrive with higher mileage and a higher risk of performance issues. Thus, lenders will be even more hesitant when drivers request financing and likely raise lending rates.

For small fleets, experts believe it may be wise to consider extending the life of their trucks and equipment through maintenance rather than buying new or used. And for any owner-operators who are searching for a used truck in today’s market, they can also expect higher down payments. In fact, those just entering the industry should be prepared to put 25-35% down. Overdrive recently surveyed a group of drivers who recently bought a used truck to further prove the state of the market. They found that 38% of used-truck buyers paid in cash, and 57% of buyers financed with a bank loan or through a captive or specialty lender.

Is a lower interest rate possible?

Despite all of this, there are ways to acquire a lower interest rate on your loan. The main factors that lenders look at to calculate the monthly payment include your credit score, the model year of your truck, how much money you put down, the owner/driver’s business experience, and your resourcefulness.

“I’d rather lend money to a guy with a 600 credit score whose father was an owner-operator, grandfather was an owner-operator, brother is a diesel mechanic, and maybe his credit score is down because of divorce,” Grivas said. “That’s a great risk compared to a guy with a 700 credit score who’s just getting started.”

When buying a new truck, experienced owners and drivers can expect a single-digit interest rate. However, drivers financing a used truck will see interest rates ranging from 10-13% or higher.

How Mission Financial Services can help.

We understand that sometimes times are tough and we’re here to get you back on the road to financial independence. Whether you’re a first-time buyer, have limited driving experience, or have bad credit, we can help.

Mission offers direct lending for owner-operator purchases, lease purchase buy-outs, repair loans, and title loans for operating capital. And even better, we will perform a complete review of applications and get you an answer within four hours.

Our approvals are structured as simple interest contracts with limited terms that let you build equity in your loan quickly to avoid additional finance charges. Mission considers all applicants living in all states except Hawaii and Alaska. And we offer affordable loans and report to all major credit bureaus so you can start turning your credit around. Why wait?

More like this:

→ How is the Microchip Shortage Affecting Truck Prices in 2022?

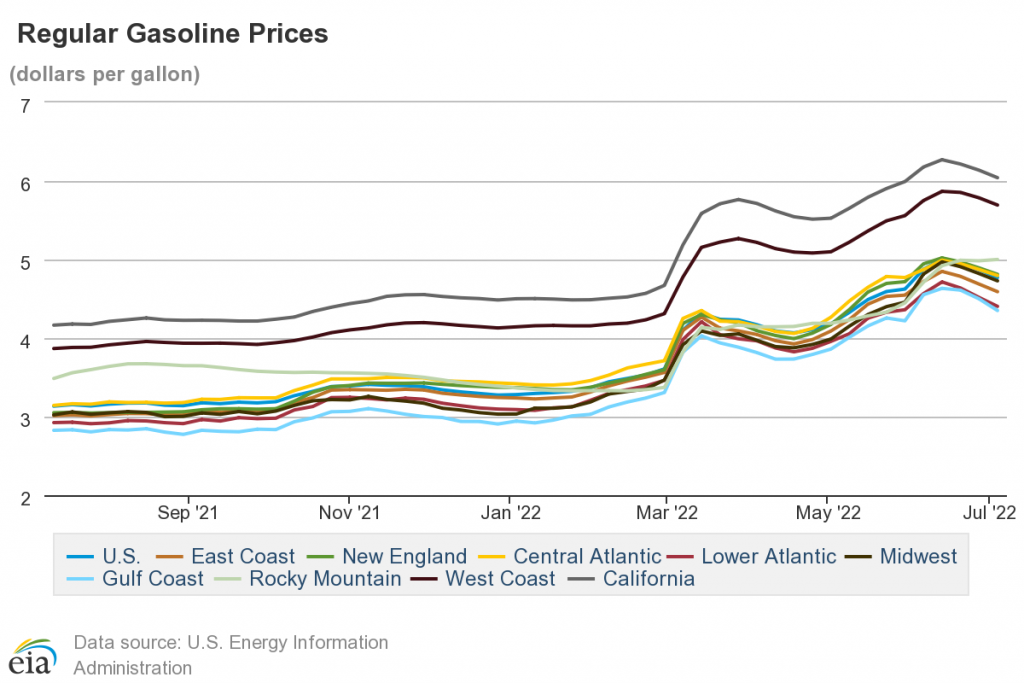

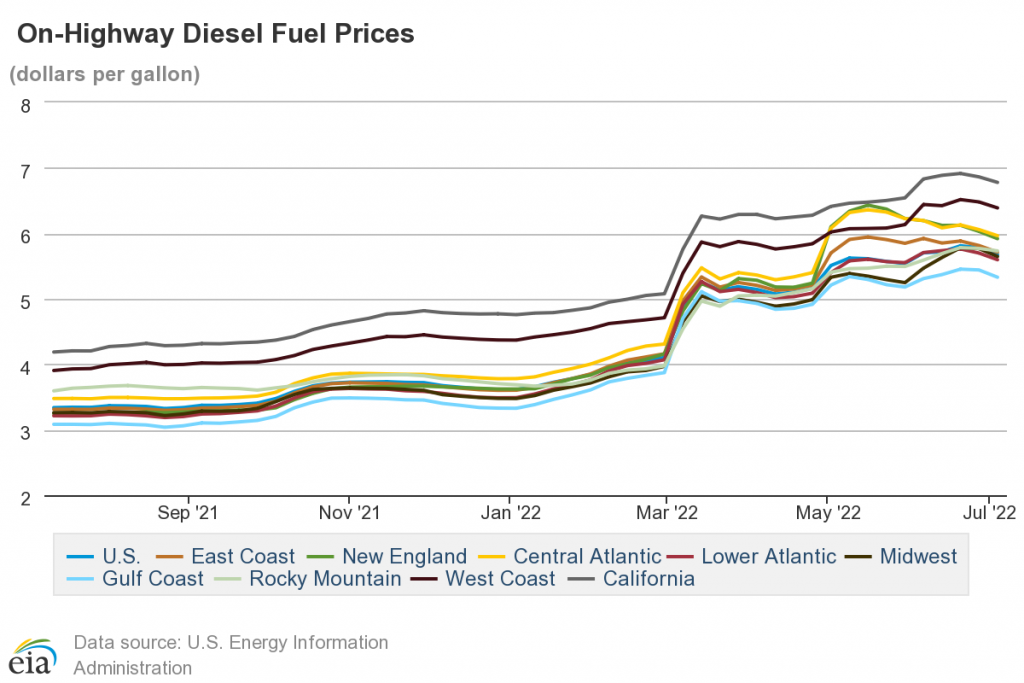

→ Rising Fuel Prices: An Ongoing Problem for Drivers

→ How Does Prop. 22 Affect App-Based Drivers?