The demand for trucking has taken a shocking turn. According to Bank of America, shipping demand is “near freight recession levels,” and the prospects surrounding freight capacity, inventory levels, and shipper rates are moving in a similar direction as they were in the Summer of 2020, at the height of the COVID-19 lockdown.

The managing director of Bank of America, Ken Hoexter, said in a recent investor’s note that a survey found that the demand for trucking is down 23% year-over-year (y/y), and the Truckload Demand Indicator fell to ‘58’— the lowest it’s been since June 2020.

So, what does all of this mean for the future economy? This article will break down what led to this decline in demand and what we can expect to see in the future.

The demand for trucking: Then vs. now

The need for trucking has, for the most part, been a significant pillar in the foundation of our country. Now, as the demand for trucking is slowly dwindling, industry experts wonder what the future holds for the trucking industry.

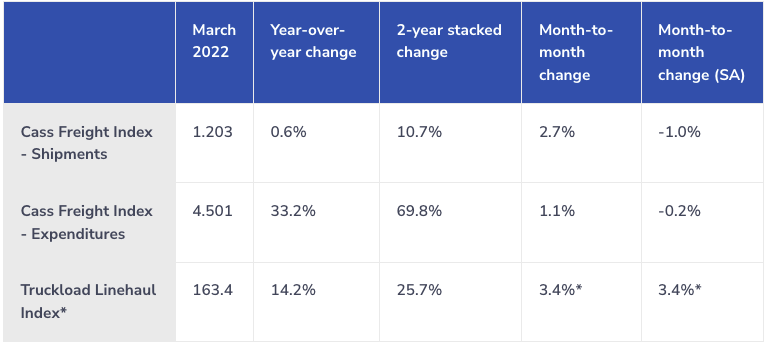

In the Cass Freight Index, the demand for domestic shipping increased 0.6% in March from the prior year (2021); the percentage is also a 2.7% increase from February. At the end of this year’s first quarter, the creeping growth rate shows Cass Information Systems Inc. that the freight industry is clearly slowing down.

The trucking industry recently experienced historical highs when it comes to freight rates, but those numbers seem to be decreasing as shipping demand and available capacity reach an equilibrium. For example, according to Bank of America, dry van spot rates (excluding fuel surcharges) are down 27% in the past month and 37% since December 2021. The analysis from Bank of America also shows that shipping rates have dropped to their lowest point since July 2020.

Why is the demand for trucking declining?

Over the years, the trucking industry has proven to be a reliable gauge for the U.S. economy’s prosperity or lack thereof. It’s simple math, really—when consumer spending declines, companies purchase less, and, as a result, business in the trucking industry dwindles.

Since 1972, the trucking industry has faced 12 industry recessions, out of which six led to larger economic issues. Now, as the Federal Reserve attempts to diminish inflation, there are growing concerns surrounding another recession that would impact both the trucking industry and the overall economy.

Cass Freight Index Report

These concerns led policymakers to raise shipping rates by a quarter-percentage point and promise half-point increases starting in May. This increase has caused freight volumes to slow. Since March, the Cass Freight Index shows shipment components are up 0.6% y/y, but this is significantly less than the 3.6% y/y growth the industry saw in February.

Other shipment component stats include:

- Although the shipments component rose 2.7% from February, the overall seasonal pattern was still 1.0% lower.

- If the Cass Freight Index used a normal seasonal pattern from March to predict shipment components for April and May, we would see an approximate 3% y/y increase in April and a 3% y/y decrease in May.

- The year-over-year shipment growth decreased to 0.4% in the first quarter of 2022 from 4.3% growth in the fourth quarter of 2021.

The changes to shipping rates have Wall Street traders predicting a 100% chance of a half-point rate increase at the beginning of May. If they are correct, this increase would be the first time the U.S. central bank has raised federal funds by 50 basis points since 2000.

While some economists believe the actions of the Federal Reserve are too late, others are concerned that stabilizing prices too quickly could trigger a wide economic recession since higher interest rates force consumers and businesses to reduce their spending.

What could this mean for the economy?

Since Class 8 vehicles move around 72% of all freight, and approximately 2 million Americans work as truck drivers, a recessionary period could be detrimental.

Suppose industries such as retail, housing, and lumber predict needing fewer heavy-duty trucks for shipping. In that case, the trucking industry would be plunged into a recession. This downturn could lead to many businesses going bankrupt, thousands of people across affected industries losing their jobs, and American families severely disrupted. Thus, leading to a nationwide economic crisis.

More Like This:

→ How to Retain Your Top Drivers During a Shortage

→ How the Russia-Ukraine Conflict Affects the Supply Chain

→ Long-Term Effects of the Pandemic on the Transportation Industry