If you work in the transportation and freight industry, then the Cass Freight Index is one of the most valuable resources available online.

This resource is used to understand transportation trends, volumes, and expenditures across the U.S. Since its conception, it’s been a valuable source of information in the industry.

In this guide, we’ll cover everything you need to know about the Cass Transportation Index and how it works. We’ll focus on some key points from the December 2022 index, mainly looking at the index insights into the trucking industry.

What is the Cass Transportation Index?

The Cass Freight Index measures the overall freight volumes and monthly freight expenditures in North America. The index has been published since 1955.

This index covers all intra-continental foresight shipments, including raw materials and finished goods. The index covers all modes of domestic transport, although truck hauls make up more than 75% of all activity.

The Cass Freight Index data is updated with monthly statistics on shipment volumes and expenditures. This data is important for understanding freight industry trends through an ongoing monthly comparison.

The Cass Freight Index is compiled by Cass Information Systems, an automated payment systems provider. Cass Freight Index shipments cover over 1200 divisions of more than 400 manufacturers and companies.

Other Indexes Related To The Cass Transportation Index

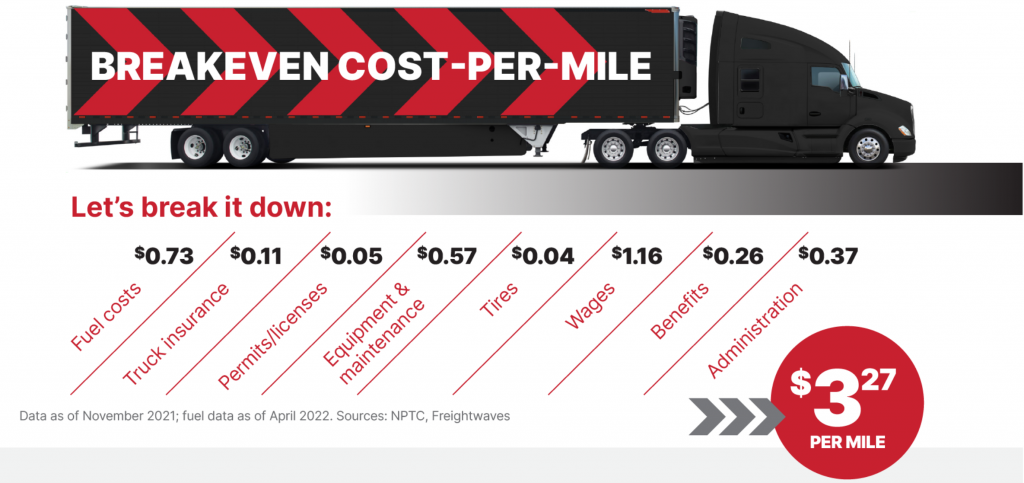

Cass Information Systems also produces the Cass Truckload Linehaul Index, which measures the fluctuations in U.S. domestic baseline truckload costs. The purpose of this is to separate the linehaul elements of truckload costs from other trucking cost components – such as fuel costs.

There is also the Cass Intermodal Price Index. With intermodal transport, the cargo stays in the same container while being transferred across different modes of transport. This index monitors changes across U.S. intermodal costs. So while the Linehaul Index only covers linehaul rates, this index monitors all costs.

There are also other indexes similar to the Cass Transportation Indexes, such as the Transportation Services Index compiled by the U.S. Department of Transportation (DOT), and the Morgan Stanley Proprietary Truckload Freight Index. These are all useful supply chain indicators and valuable resources for monitoring freight trends.

The Cass Truckload Linehaul Index

As mentioned above, the Cass Truckload Linehaul Index monitors baseline truckload costs in the U.S. This monthly index measures the market fluctuations in truckload linehaul rates per mile. This index provides an accurate indication of market fluctuations in truckload pricing in the U.S.

Because this index only looks at the linehaul component of truckload costs, the freight transportation industry can use it as an accurate reflection of trends in baseline truckload prices. As trucking makes up the vast majority of recorded Cass shipment volumes, this index offers some of the most valuable industry insights.

How is it Measured?

Data from the Truckload Linehaul Index comes from freight invoices paid on behalf of the entire Cass client base, a combination of contract and spot rates.

As Cass manages $44 billion in freight spending each year, this data provides meaningful insight into transportation industry trends.

To measure freight shipments in this index, the per-mile linehaul rates are monitored, independent of any other cost factors – like accessorials or fuel.

Key Points: Cass Transportation Index December 2022

The Cass Freight Index is a valuable source of information for anyone involved in the transportation industry. Here are some key takeaways from the December 2022 Cass Shipments Index:

- Cass Freight Index shipments were measured at 1.161, a -3.9% year-over-year change.

- Cass Freight Index expenditures were measured at 4.231, a -4.3% year-over-year change.

- Freight rates are on track to fall 5% in 2023, based on the normal seasonal pattern of this index.

- Cass Inferred Freight Rates were measured at 3.644, a -0.4% year-over-year change.

- The index saw sharp declines in ocean rates and many commodity prices.

- Expenditures in the Cass Freight Index rose 23% in 2022 after a record 38% increase in 2021.

Key Points From The Truckload Linehaul Index

- Truckload Linehaul Index was measured at 150.54, up by 1.7% on a year-over-year basis.

- Spot rates were down significantly on this index.

- The larger contract market is adjusting downward more gradually.

- New truckload contracts are mostly being renewed with notable rate reductions.

Final Thoughts

If you’re going to stay on top of monthly trends in the freight and supply chain sector, then the Cass Index is possibly the best place to access this data. Understanding this index and monitoring monthly data changes will help any trucking and freight business make more informed decisions.

Looking at the key trends from the December 2022 report is important, as it helps you better understand the state of the industry going into the new year. This provides valuable insights into trends for the year ahead.