Throughout the past two years, supply chains have muscled through numerous challenges as the COVID-19 pandemic impacted industries all over the world. As Russia invades Ukraine, the world’s supply chains face more opposition. And while the problems are significant, new reports show they may worsen.

According to a Dun & Bradstreet report, 374,000 businesses worldwide use Russian suppliers, while approximately 241,000 businesses use Ukrainian suppliers. Out of all of those businesses, around 91.5% of them are based in the United States.

So how will this ongoing conflict continue to affect our supply chains? Which industries will be hit the hardest? And what can we anticipate going forward? We’ve got all the answers here.

What is the Russia-Ukraine Conflict?

On February 24, 2022, Russia initiated a full-scale military invasion of Ukraine. Since then, the death toll has reached well over 200, explosives have ravaged the country, and millions of Ukrainians have fled to neighboring countries. This growing conflict has spread well beyond Ukraine and thoroughly disrupted the world’s shipping and freight industries.

Since the start of the invasion, Russian forces have caused shipping routes to be cut off, logistic firms to suspend services, and air freight rates to hit an all-time high. All of this has caused severe impacts on the global market, and many industries are feeling the overwhelming sting of this war.

Biggest impacts on the supply chain

The most affected industries include:

1. Fuel

At this point, we’ve all seen the astronomical prices at our local filling stations. As of March 11, the United State’s national average hit $4.33 per gallon, And in states like California, Hawaii, Nevada, and Oregon, people are paying more than $5 per gallon. These extreme prices have started to impact other parts of the economy as well. For instance, drive share and shipping companies have increased what they charge consumers to counteract fueling costs. Other industries that rely on fuel, like farming and construction, have also had to rethink their budgets, leading to higher prices at the grocery store and layoffs on job sites.

→ How the Gas Shortage has Affected the Trucking Industry

2. Raw Materials

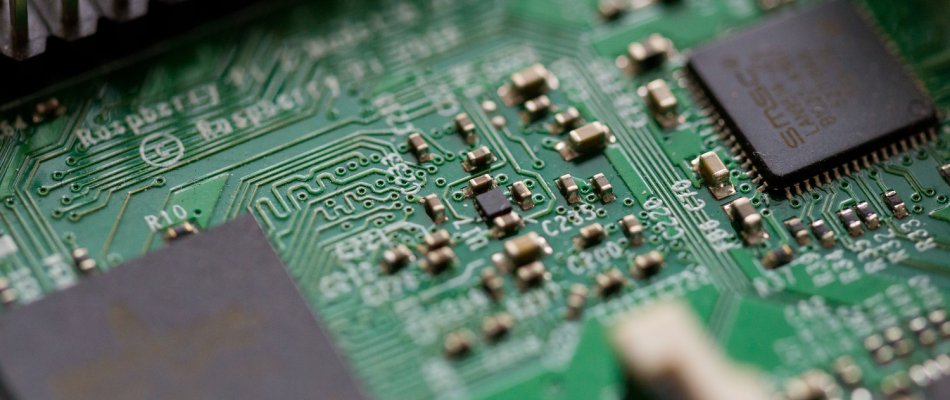

Ukraine has slowly become one of the largest raw material suppliers in the world. They exported several materials, such as chemical products, minerals, transportation equipment, and other products. Since the invasion, Ukraine has been forced to increase the cost of its exports. This has caused many countries to slow down the manufacturing of electronics, homes, and vehicles. In some cases, companies have had to shut down production. Ukrainian allies have also ceased trade with Russia, thus losing access to large amounts of nickel, platinum, and 10% of the global copper reserves. These elements play essential roles in producing semiconductor chips, automobiles, jet engines, medicine, etc.

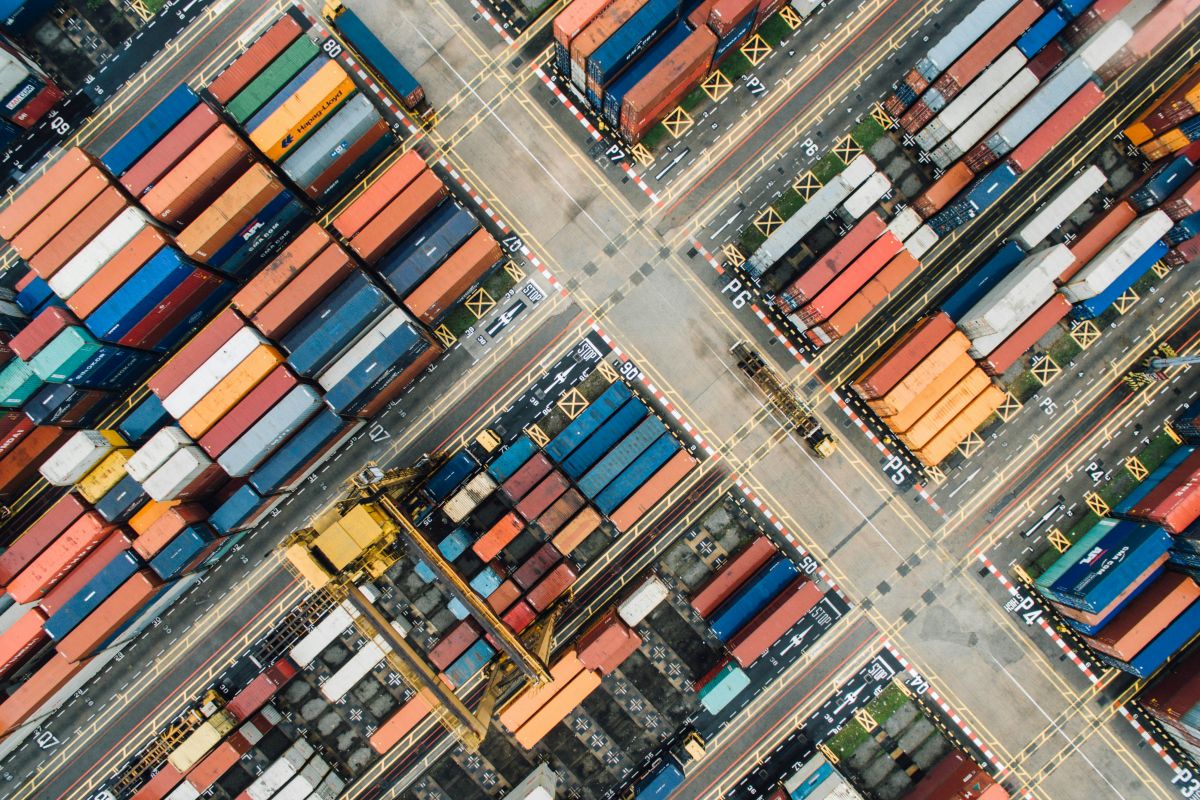

3. Shipping & Transportation

Another industry affected by the Russia-Ukraine conflict is shipping and transportation. Freight companies have started rerouting ground, ocean, and air shipping to avoid Russia and minimize fuel costs. This has led to longer transportation times and higher shipping costs for consumers.

For example, imports leaving Asia take approximately four hours longer to reach their destinations since the cargo jets can no longer fly over Russia. These jets use up to 20,000 pounds of fuel per hour of flight. And with fuel being more expensive, freight companies have no choice but to raise prices for consumers.

4. Automotive

Since the start of the pandemic in 2020, the automotive industry has struggled with production and inventory shortages. Unfortunately, these troubles don’t seem to be subsiding anytime soon. The sudden increase in the price of fuel, steel, aluminum, and nickel has placed further pressure on the already fragile industry. The more expensive materials force automobile and automotive part manufacturers to slow down or cease production until prices stabilize. Meaning consumers will also continue to experience low inventory levels.

What can we expect moving forward?

As the conflict in Ukraine continues, trucking rates and other transportation costs could continue to increase as the price of oil rises. However, the overall outcome of this invasion is filled with a lot of uncertainty. For this reason, supply chains must prepare and improve their operations by “balancing investments in dedicated teams, processes, and technologies that will enable their organizations to implement end-to-end risk management,” says an analyst from Gartner.

More Like This:

→ How is the Microchip Shortage Affecting Truck Prices in 2022?

→ Where Did All of the Trucks Go?

→ How will the Trade War Between China and the U.S. Impact the Trucking Industry?