Is Your Semi Truck’s Kingpin About to Fail? King pin wear and tear is a common issue with semi-trucks. It’s also essential that truck drivers can identify this issue early on. Otherwise, a failed kingpin results in all kinds of serious problems with your vehicle.

Just like you need to check your fuel filters, starter, or shocks, regularly checking your kingpin is essential for a well-maintained semi-truck. In this guide, we break down common signs of kingpin failure, and when you need to replace these parts.

What is the Kingpin?

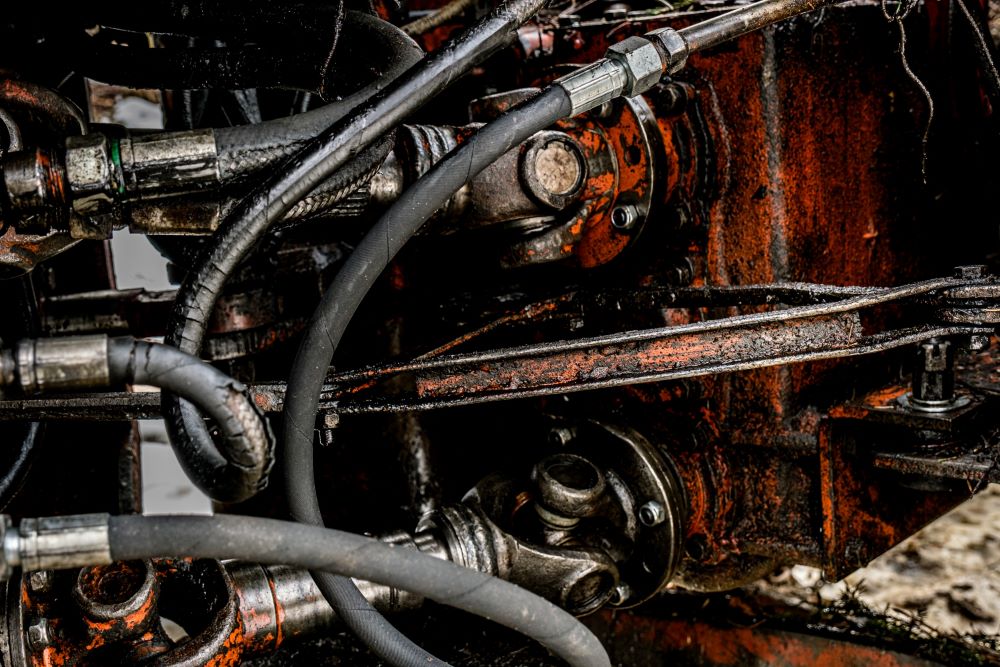

A kingpin is a crucial component of your vehicle’s trailer hitch system. It’s a large, sturdy pin that connects the trailer to the semi-truck fifth wheel, allowing for articulation and movement between the two parts of the vehicle.

The Kingpin fits into a receptacle on the fifth wheel, securing the trailer to the truck while still allowing it to pivot and maneuver, particularly during turns. It plays a vital role in maintaining stability and control while the truck is in motion, especially when navigating curves or uneven terrain.

Basically, you need to have a kingpin to safely haul a trailer.

Semi-Truck Bad Kingpin Symptoms

King pin wear is a common issue among truckers. When you have a worn kingpin, it could cause all kinds of additional issues to your truck, including impacting your safety.

To help you identify this issue, here are some of the most common signs of a worn kingpin.

Hard to Couple

When you have difficulties in coupling the trailer to your semi-truck, it could point to various underlying issues related to the kingpin.

Start by ensuring that you properly align the trailer with the fifth wheel of the truck. Check if the trailer is at the correct height and angle for coupling. Even a slight misalignment can make coupling challenging.

If alignment seems correct and coupling is still difficult, inspect the kingpin for any signs of damage or misalignment. Look for visible wear and tear on the kingpin, such as cracks, dents, or bending. Examine the truck’s fifth wheel to see if any obstructions or debris prevent the kingpin from engaging properly.

Addressing incorrect vehicle alignment issues and inspecting both the kingpin and fifth wheel can help you find out why it’s hard to couple.

Hard to Uncouple

Struggling to uncouple the trailer from your semi-truck can be just as frustrating as coupling difficulties and could also come from issues with king pins.

Begin by making sure you fully release the trailer brakes to minimize resistance during uncoupling. Try gently maneuvering the truck back and forth to relieve any pressure that might be preventing the kingpin from disengaging smoothly.

If uncoupling is still an issue, inspect the kingpin mechanism for any signs of damage or wear. Pay close attention to the locking mechanism on the fifth wheel to ensure that it’s functioning correctly. Sometimes, a buildup of dirt or debris in the locking mechanism can make it tricky for king pins to uncouple.

Fifth Wheel Adjustment Will Not Tighten

Difficulty in tightening the fifth wheel adjustment can be a clear indication of kingpin-related issues. If this is the case, it needs to be addressed straight away as it would create unsafe hauling conditions.

Two common problems to consider are a worn-down throat and a worn-down shoulder on the kingpin.

Worn Down Throat

Inspect the throat of the kingpin for signs of wear and tear. This is a normal issue because of prolonged use and a lack of maintenance.

A worn-down throat can result in poor engagement with the fifth wheel, making it challenging to achieve proper tightness when adjusting the fifth wheel.

Look for any irregularities, like grooves, scratches, or deformations on the surface of the kingpin throat. If you see significant wear, then your kingpin might need to be replaced.

Worn Down Shoulder

Similarly, examine the shoulder of the kingpin for any signs of wear or damage.

The shoulder plays an important role in ensuring a secure connection between the kingpin and the fifth wheel. If the shoulder is worn down or damaged, it can affect the stability and tightness of the coupling, leading to difficulties in adjusting the fifth wheel.

Check for flat spots, dents, or uneven surfaces on the kingpin shoulder, as these can interfere with proper seating on the fifth wheel.

Lack of Lubrication

Proper lubrication is essential for keeping your kingpin mechanism operating smoothly and preventing premature wear and tear.

Without enough lubrication, friction between the kingpin and the fifth wheel can increase, making coupling and uncoupling more challenging.

Regularly inspect the kingpin and fifth wheel for signs of grease buildup or dryness. Clean any accumulated debris or old grease from the surfaces and apply a generous amount of high-quality lubricant to ensure smooth movement.

Pay special attention to areas where metal-to-metal contact occurs, such as the kingpin throat and shoulder, as these areas are particularly susceptible to wear. A kingpin can last forever if you lubricate it properly.

When is it Time to Change Your Kingpins?

It’s time to change your kingpins when you notice signs of wear and tear or experience issues with steering and stability in your semi-truck. Here are some clear signs that it might be time for a replacement:

- Looseness or play: If you feel excessive looseness or play when hitching your fifth wheel, it could be a sign that the kingpin is worn out.

- Steering issues: A damaged kingpin could affect your steering knuckle. If your steering wheel isn’t responding as it normally would, and you’re finding it hard to steer tires in the right direction, then it could be because of an issue with your kingpin.

- Visible damage: Check your kingpin for any visible signs of damage, like bending, cracking, or corrosion.

- Rust or corrosion: If you notice rust or corrosion on the kingpin, it’s a clear sign that it needs replacement.

- Uneven wear: Inspect your kingpin for uneven wear patterns. If one side of the kingpin is significantly more worn than the other, it could affect the stability and performance of your truck and trailer.

- Age and usage: Even if there are no visible signs of damage, consider the age and usage of your kingpin. Over time, these parts can wear out from regular use and exposure to the elements.

- Tire wear: A bad kingpin can cause alignment and steering issues, which could cause uneven wear on your tires. If you notice this issue with your tires, check your kingpin to see if it’s still working properly.

In general, if you suspect that your kingpin is causing issues with your truck’s performance, it’s best to replace it sooner rather than later. This is important to help you avoid accidents and to keep other parts of your vehicle in good working order.

Final Thoughts

Although maintaining your king pin may seem time-consuming, it’s a small price to pay for keeping your truck and trailer in good condition. A failed king pin could become a serious issue, so it’s best to address this early on.

Looking to purchase a new semi-truck? Then get in touch with us at Mission Financial Services, where we make it easy to help you access funding for your vehicle.