Have you ever thought about starting your own business? How about starting your own trucking business? If you answered yes, you are in luck because there’s never been a better time to get started.

As the popularity of online shopping rises and the world’s shipping demands rapidly increase, owners and operators alike can anticipate more opportunities on their horizons. To meet the growing demands of consumers, the American Trucking Association (ATA) estimates that the trucking industry would need at least 900,000 new drivers on the road. These factors, plus the current driver shortage, strong freight market, and increased transportation rates, equal an abundance of opportunities for those wanting to start their own trucking business.

So, how exactly do you get started?

6 Tips For Starting Your Own Trucking Business

While running your own fleet operation can come with a number of enticing benefits, it can be challenging to get everything started if you don’t have the proper tools for success.

Below, we’ll break down the steps you need to take and discuss how to create a solid trucking business.

1. Plan and prepare.

Not surprisingly, starting a business takes a significant amount of planning and preparation, regardless of having zero industry experience or years under your belt.

Some things to think about and plan for include:

1) The name of your trucking business

Choosing a proper name for your business is crucial. Once you’ve decided on a name and checked to ensure another company is not using it, be sure to acquire a DBA if you chose a “fictitious name” or an LLC if you are operating under your name and/or professional alias.

2) What’s your target market

Establishing your trucking business as a “niche carrier” (e.g., local hauler vs. refrigerated hauler) is vital if you want to avoid competition, optimize your opportunities, and streamline the costs and resources you’ll have to prepare for.

If you’re stuck deciding on your company’s niche, ask yourself:

- Which industries, companies, and/or products do I find interest in? Is it in my target location? What’s my competition, if any?

- What does this niche require in terms of product and logistics? Am I capable of meeting these requirements?

- Who would my customers be? How will they benefit from me versus another company? How would I benefit from them?

3) Identify your rates

Deciding on your company’s rate can be a challenge. Your rate should generate profit, cover any costs, and compete with any neighboring competition.

To calculate your rate, follow these steps:

- Choose your desired area and freight lane

- Go to the local load site and find 10 loads going in the same direction

- Contact the brokers of the 10 loads and inquire about how much they are paying

- Calculate the average amount and add 10-15% to determine the price shippers are billed

- Now, repeat these steps for shippers going in the opposite direction

2. Obtain the proper paperwork.

As a business owner, it’s your responsibility to obtain the proper permits and legal documentation needed to operate. This paperwork will vary based on the type of niche your company is.

Potential permits and licenses include:

- US DoT and Motor Carrier (MC) Authority Numbers

- Unified Carrier Registration (UCR)

- International Registration Plan (IRP) License Plate

- Heavy Highway Use Tax Return (Form 2290)

- International Fuel Tax Agreement (IFTA) Permit

- BOC-3 Form

- Weight/Distance Travel Permits

- Standard Carrier Alpha Code (SCAC)

- Electronic Logging Devices

3. Create a business plan.

For any business, a detailed business plan is an essential tool for success. A comprehensive business plan should detail sales and marketing strategies, operational activities, a pricing breakdown, your fleet management plan, company goals, a resource breakdown, and any other business processes that will help keep you organized as your business grows.

A complete business plan may also include:

- The company description

- A market analysis and service business analysis

- The company’s sales strategy and financial projections

- A personnel plan with management and organization details

- An executive summary

- Any key activities, partnerships, & resources

- Your customer segments

- Any value propositions

- Your company’s cost structure

4. Purchase company assets and insure them.

If you have substantial funding, now is the time to purchase your company assets, including your commercial vehicles. And while there is nothing wrong with getting the best deal, don’t neglect the quality of your purchases. When getting started, paying a higher price for a brand-new truck may not sound appealing; however, this will save you money down the road with less required maintenance and fewer repairs.

If you choose to buy a used heavy-duty truck, you should investigate the vehicle’s maintenance history and look for/at:

- Signs of damage

- Rust or deterioration

- Proper tire tread

- Mileage and other gauge readouts

Once you have purchased your assets, be sure to insure them immediately. By obtaining insurance, you protect yourself and your company against financial burdens and risks, including vehicle damages and employee injuries.

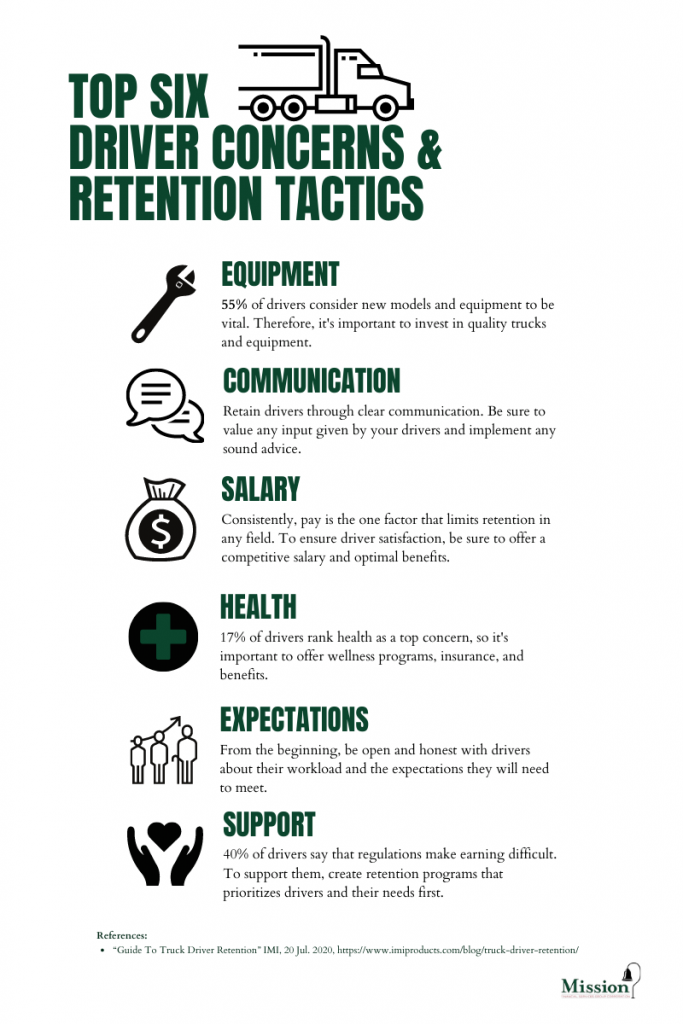

5. Hire your employees.

Who you bring onboard is arguably one of the most important components to growing your business. There are a few ways to handle the hiring process. Still, it’s recommended to go through certified screening procedures to determine if a potential employee holds any violations, crash reports, or unfavorable record hits.

Certified screening procedures include:

- Running the applicant’s CSA profile and a thorough background check

- Conducting a detailed in-person interview

- Completing on-the-job tests and evaluations

6. Now, grow your business.

Now that most of the nitty-gritty details are taken care of, it’s time to grow your business! For optimal profitability, diversify your business and never allow a single client to account for over 20% of your revenue, meaning you should have at least five consistent clients. If you need more clients, you can use online tools, including freight boards, a company website, industry networks, and/or social media. With your company’s website and social media accounts, be sure to keep things professional, up-to-date, and consistent with relevant content like services, hours of operation, and company details. If you post any photos and/or videos, only use high-quality content and take the opportunity to interact with your followers any chance you get.

Other tools trucking companies use for growth and success include:

- Fleet management software

- An ELD solution

- Real-time GPS tracking, geofencing, and facility insight reports

- AI-powered dashcams

These tools can optimize your company’s time, cut down excess expenses, help improve your driver’s productivity and safety, simplify insurance claims, and protect your business. Plus, they keep downtime to a minimum and keep clients happy, encouraging them to spread the word about your company.

Get started with Mission Financial.

When starting your own trucking business, it’s essential to obtain proper coverage. At Mission Financial, we not only offer direct lending, but we also offer dealership lending. Our specialized loans cover first-time owners/operators, drivers with limited experience, and owners/operators with bad credit, bankruptcies, child support, or tax liens, plus small fleet loans.

To obtain a loan from Mission Financial, you will need to complete and submit three online forms, including a credit application, vehicle spec sheet, and sales order.