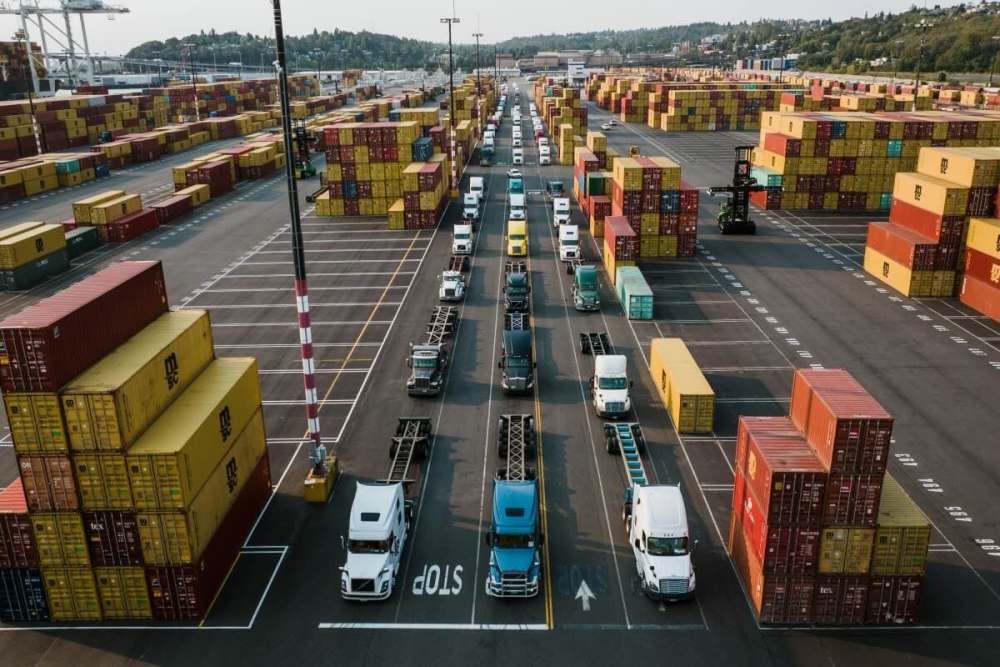

Diesel prices are trending upward, and even small increases are making a big impact on the bottom line for truckers. As of August 2025, the national average for on-highway diesel is $3.80 per gallon.

That’s up nearly five cents from this time last year, with some regions seeing even sharper spikes.

In the Rocky Mountain region, diesel is up more than nine cents year-over-year. California prices remain the highest in the nation at $4.95, marking a 12-cent jump over last year. And on the West Coast outside California, the increase is even steeper – up nearly 24 cents per gallon.

With more financial pressure on owner-operators, understanding what’s driving the trend (and how to respond) is critical.

What’s Driving Diesel Prices in 2025?

The current rise in diesel isn’t just about seasonal shifts. Multiple economic and geopolitical factors are influencing price volatility.

Global Supply Pressures

The global oil market remains tight. OPEC+ has continued production limits through mid-2025, keeping crude supply constrained. This affects diesel prices directly, especially when global demand stays steady or rises.

Meanwhile, US refinery capacity is still lagging behind pre-pandemic levels. According to the EIA, total US operable refinery capacity has dropped nearly 4.5% since 2020. That bottleneck is particularly visible on the West Coast, where environmental rules limit expansion and prolong maintenance downtimes.

Regional Disruptions

California and surrounding states are especially vulnerable to price shocks due to their limited access to interstate pipelines and more expensive blends of diesel fuel.

As of August 2025, California diesel prices hover around $4.95 per gallon – nearly $1.50 above the Gulf Coast region average. These regional gaps create unpredictable operating costs for truckers covering long hauls.

Inflation and Compliance Costs

While overall inflation has cooled slightly, costs tied to refining, fuel transport, and regulatory compliance remain high. Emissions mandates and low-carbon fuel standards add expense at every stage, from the pump to the supplier, and those costs are passed on to drivers. Small commercial truck operators, who often lack the scale to negotiate better fuel rates, bear the brunt.

Economic Uncertainty and Market Reactions

Even without direct disruptions, diesel prices often react to broader economic uncertainty. In 2025, global inflation still lingers, and interest rates remain elevated.

When the market anticipates supply chain shocks, geopolitical tensions, or lower refinery output, diesel prices can spike in anticipation. That volatility makes it harder for small trucking businesses to budget fuel costs per mile from one month to the next.

Impact on Small Fleets and Independent Operators

For smaller operators, higher diesel costs are a serious financial strain. Increased fuel expenses directly reduce take-home profits. And for many, there’s little room to absorb the hit.

Tight margins mean higher operating costs can quickly pressure cash flow. For drivers already managing truck loans or repair bills, that’s a recipe for stress. In some cases, it may contribute to missed payments, refinancing struggles, or loan defaults.

We’re also seeing signs of broader financing stress in the industry. Recent spikes in trucking bankruptcies and a growing inventory of repossessed used trucks suggest more operators are exiting the market or being forced to surrender equipment.

As traditional banks pull back from small-ticket commercial lending, some drivers may find themselves shut out of credit options just when they need support the most.

Strategies to Manage Diesel Price Volatility

Fuel prices may be out of your hands, but how you respond isn’t. With margins shrinking, small fleets need practical ways to stay ahead of rising diesel costs.

Here’s what works:

- Build surcharges into your contracts: If you’re hauling under contract, make sure fuel surcharges are clearly outlined. Align them with current rates and ensure they adjust as diesel prices move. Without this, you’re covering rising fuel costs out of pocket.

- Run leaner, smarter routes: Fuel efficiency starts with smarter planning. Use real-time routing tools to avoid delays, reduce idle time, and group deliveries. Keep up with preventive maintenance, especially tire pressure and engine performance, to stretch every gallon.

- Lock in fuel discounts or prepaid rates: Some providers, like AtoB Fuel Card, offer prepaid programs or discount cards that reduce price swings. If your routes are consistent, locking in fuel rates can give you more predictable expenses and better cash flow control.

- Reevaluate financing relationships: Tighter margins make flexibility even more important. If your current lender isn’t adapting to the market, it may be time to explore alternatives.

Independent lenders like Mission Financial Services understand what small operators face and offer repair loans, title loans, and working capital solutions that move fast when you need them most.

Conclusion

Diesel prices are climbing again, and the effects are real. Higher costs eat into profits, tighten cash flow, and make it harder to stay current on equipment payments. For many small fleets, the pressure is building.

Now’s the time to reassess your fuel strategy, control what you can, and work with lenders who offer support, not roadblocks.

At Mission Financial Services, we’re here to help owner-operators navigate these challenges with fast approvals, flexible programs, and real trucking industry experience. Contact us today for simple and fast trucking solutions.