Commercial truck financing rates can make or break the deal when it comes to buying your next semi, box truck, or dump truck. And for owner-operators and small fleets, the difference between a 9% and a 14% rate can mean hundreds of dollars added to your monthly payment and thousands lost over the life of the loan.

With operating costs continuing to rise and commercial truck financing rates ranging from 6% to 35% in 2025, understanding current semi truck interest rates is more than good business sense; it’s survival. To help you make the best possible choice, we’ll cover today’s commercial truck financing rates and exactly how you can put yourself in the driver’s seat when it comes to negotiating better terms.

What Are Commercial Truck Financing Rates?

Commercial truck financing rates are the interest percentage lenders charge when you take out a loan to buy or repair a commercial truck or other commercial vehicle. These rates shift based on several factors, including your credit history, the lender’s risk assessment, the type of truck you’re financing, and overall market conditions.

For truck drivers and small businesses, the financing rate directly affects day-to-day operations:

- Monthly payments: Higher rates increase what you owe every month, leaving less room in your budget.

- Total cost of ownership: Interest adds up over the loan term, raising the actual price of your truck.

- Cash flow and growth: Lower rates free up more money for essentials like fuel, repairs, and payroll.

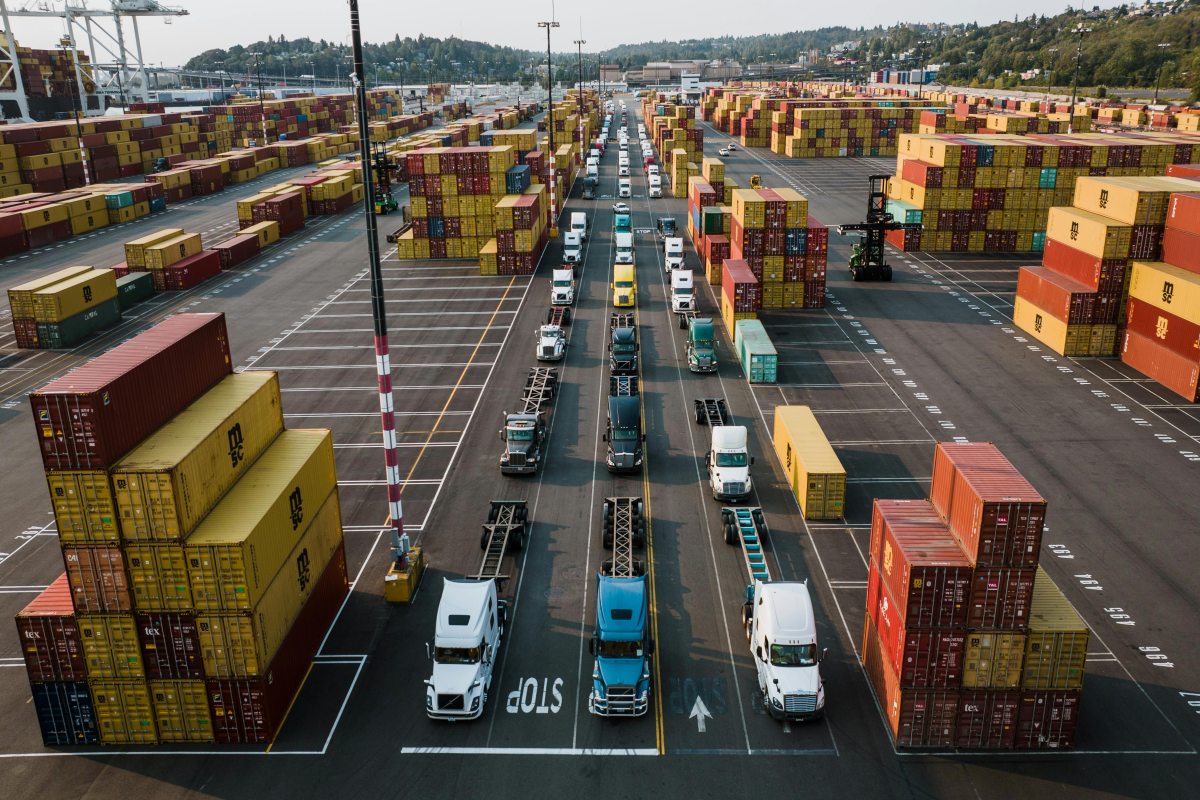

In short, securing a loan with competitive commercial truck interest rates helps you keep trucks on the road, expand your fleet, and stay competitive in the industry.

Average Commercial Truck Financing Rates in 2025

If you’re planning to purchase a semi truck or expand your fleet this year, knowing the average commercial truck financing rates can help you budget realistically and avoid surprises.

Commercial Truck Loan Rates for New vs. Used Vehicles

In 2025, interest rates on new commercial trucks are generally lower than those for used trucks. Lenders view newer vehicles as a safer investment since they carry fewer repair risks and hold their value longer.

- New trucks: Average financing rates hover around 8% to 10%, with well-qualified buyers sometimes seeing rates as low as 6%.

- Used trucks: Rates are higher, averaging 12% to 14%, with some borrowers facing 15% or more depending on credit and lender type.

For first-time buyers, used trucks may look more affordable upfront, but higher semi truck financing rates can add thousands to the total cost of ownership over the life of the loan.

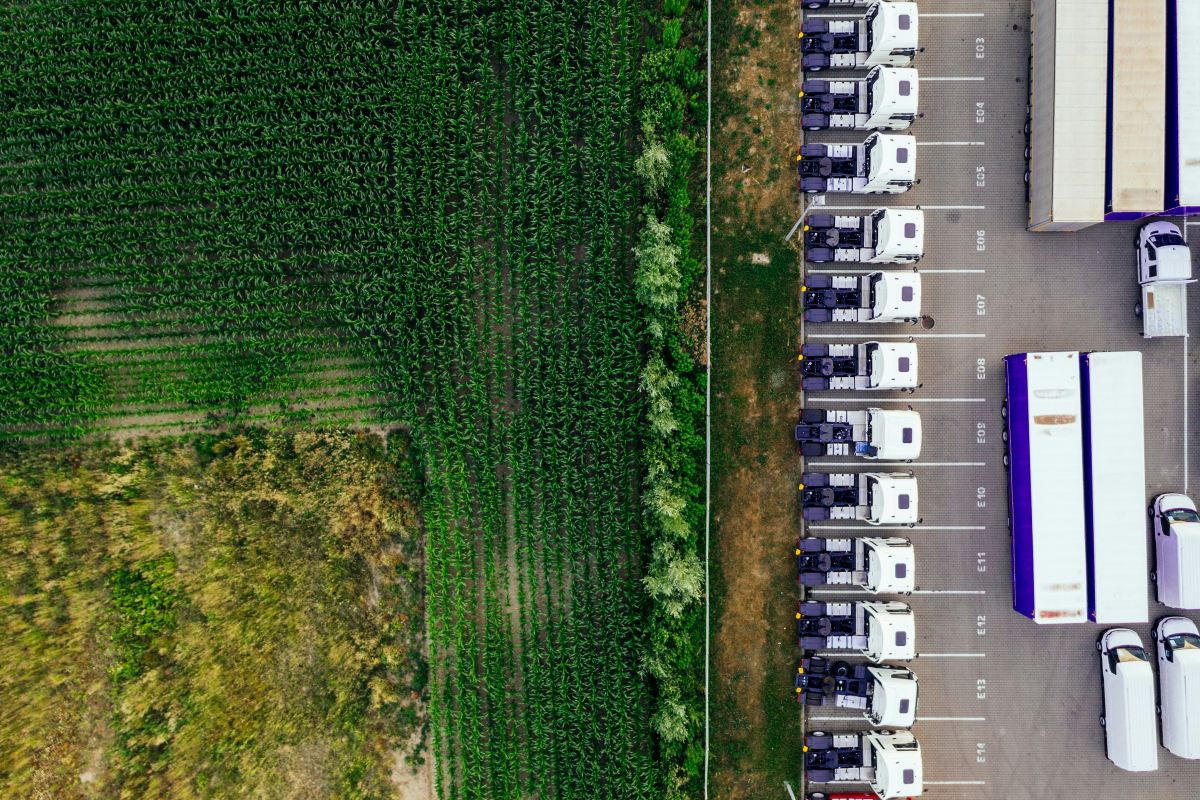

Rate Ranges for Owner-Operators vs. Fleets

Owner-operators typically face higher commercial truck financing rates compared to small fleets. Established fleets (those managing multiple trucks) demonstrate stronger business cash flow and financial history, lowering lender risk and unlocking better terms.

- Owner-operators: Interest rates for semi-truck loans can range broadly from 6% to 35%, depending on creditworthiness and lender type. Anything under 10% is considered strong, but those with more limited credit or newer businesses may fall into much higher tiers, especially on the upper end of that range.

- Small fleets (1–10 trucks): Usually face higher rates. While specific percentages vary widely, their financing costs tend to fall above the small-fleet range, driven by lenders’ heightened risk concerns.

First-time buyers and newer owner-operators may find initial financing options accessible, but they should be prepared for higher semi truck financing rates until their business credit and revenue track record improve.

Rate Differences by Loan Type

Different financing channels offer different semi truck loan rates, and each option comes with its own trade-offs.

Bank Loans

These typically start around 7% or higher for qualified borrowers. Banks usually offer the lowest commercial truck loan interest rates, along with longer repayment terms. However, they require a strong credit score, a larger down payment, and a detailed financial history. Approval can take weeks, which isn’t always ideal if you need a truck quickly.

SBA Loans

Backed by the Small Business Administration (SBA), these loans typically range from 11% to 16%, depending on whether the rate is fixed or variable. They’re considered competitive because they come with long repayment terms and government guarantees that reduce lender risk. The downside is the process: expect significant paperwork and longer wait times before funds are released.

Online or Direct Lenders (like Mission Financial Services)

Direct and alternative lenders offer a wide range of semi truck loan rates, typically from 9% up to 30% or more, depending on credit profile and business stability. The advantage is speed (some approvals can happen in 24 to 48 hours) and flexibility, especially for drivers with bad credit or limited history. For example, a driver who doesn’t meet the minimum credit score requirements could still secure a bad credit loan through Mission Financial to purchase a used semi truck.

While the interest rate may be higher than traditional lenders, fast approval and flexible repayment terms allow you to get back on the road, generate income, and eventually refinance when your credit improves.

In-House Dealership Financing

While convenient, dealership financing often comes with higher interest rates and added fees. The process is straightforward; you can choose your truck and financing in one place, but the lack of competitive shopping usually means you’ll pay more over the life of the loan.

Professional grade big rig semi truck with chrome accessories

Key Factors That Influence Truck Financing Rates

While we touched on some of these earlier, it’s worth looking at them together as a quick checklist. Knowing how lenders evaluate risk helps you understand why your rate might look higher or lower than average and what you can do to improve it. Use this list to spot areas where you can strengthen your loan application and find the best options for your business:

- Credit score and credit history: Higher scores mean lower rates; weak credit pushes rates up.

- Down payment size: A larger down payment reduces the loan amount and usually unlocks better terms.

- Truck age and mileage: Newer trucks cost less to finance, while older models with high mileage raise rates.

- Type of truck: Semi trucks often get better rates than niche vehicles like dump trucks or delivery vans.

- Loan amount and repayment terms: Longer terms can increase interest costs, while shorter terms may come with lower rates but higher monthly payments.

- Business finances and cash flow: Steady income reassures lenders and can secure more favorable rates.

- Length of time in business: Established fleets pay less than first-time buyers with no track record.

- Collateral (titles or other assets): Offering collateral reduces risk and can lower interest rates.

- Lender type and competition: Banks may advertise the lowest rates, while direct lenders offer faster approvals and more flexibility for drivers with limited credit.

Each of these variables shapes the semi truck financing rates available to you, and improving even one or two of them can help reduce borrowing costs.

Market Trends Impacting Rates in 2025

As we move deeper into 2025, several real-world trends are actively reshaping the landscape for semi truck financing.

Interest Rate Environment

The Federal Reserve has already enacted multiple rate cuts, including a quarter-point reduction earlier this year, and projects just two additional cuts for the remainder of 2025. At the Jackson Hole symposium, Chair Jerome Powell hinted at further cautious easing tied to economic data, but emphasized inflation remains a concern. For commercial borrowers, this means loan rates may edge down modestly, though only well-qualified buyers are likely to benefit meaningfully.

Supply Chain and Truck Availability

Though production struggles are easing, manufacturers remain hesitant to ramp up output, leaving new truck availability tight. Especially for high-demand models like delivery vans and refrigerated units. This supply constraint keeps truck prices elevated and nudges more buyers toward the used market, where financing rates tend to be higher.

Demand, Regulation, and Freight Dynamics

The US trucking sector continues its gradual recovery from the downturn of 2022–23. Despite a modest year-over-year freight demand growth forecast at just 1.8%, both pricing and capacity remain muted. New tariffs and regulatory uncertainty are also muddying the waters for fleet operators. Meanwhile, the ongoing driver shortage (estimated at over 80,000 drivers this year) continues to strain capacity and raise operating costs.

How to Get the Best Commercial Truck Financing Rates

Securing favorable truck financing rates requires preparation. Small businesses and drivers can take several steps to lower semi truck interest rates and improve loan approval odds.

1. Improve Your Credit Score Before Applying

A stronger credit score is one of the most effective ways to qualify for better commercial truck loan interest rates. Even small improvements can make a noticeable difference in your monthly payment. To build or strengthen your credit:

- Pay down existing balances when possible.

- Make on-time payments a consistent habit.

- Limit new credit inquiries to what’s truly necessary.

If your credit is still a work in progress, don’t be discouraged. Direct lenders, such as Mission Financial, work with drivers who have less-than-perfect credit. You may start with a higher rate, but building credit over time opens the door to refinancing or securing lower semi truck financing rates in the future.

2. Save for a Larger Down Payment

A larger down payment not only lowers your loan balance, but it also shows lenders that you’re committed, which can help you qualify for better semi truck financing rates. Even setting aside a little extra each month makes a difference over time. The more you can put down, the more manageable your monthly payments and total loan costs will be.

3. Choose the Right Truck for Better Approval Terms

The truck you choose plays a big role in your financing terms. Lenders typically view newer trucks or well-maintained used models as lower risk, which often translates into lower rates. Focusing on vehicles with strong resale value can improve your approval odds and set you up for a smoother financing process.

4. Compare Multiple Lenders and Loan Offers

Not all financing offers are created equal. Rates and terms can vary widely between banks, SBA loans, online lenders, and direct lenders. Taking the time to compare a few options helps ensure you’re getting the most competitive deal available. Be mindful of extras like prepayment penalties or hidden fees, and prioritize lenders that offer flexibility.

5. Consider Refinancing When Market Rates Drop

If you already have a semi truck loan, refinancing can be a smart way to adjust as market conditions change. Lowering your rate later on can reduce monthly payments, shorten repayment terms, or cut down the total interest you’ll pay. Keeping an eye on financing trends gives you the chance to improve your loan terms even after you’ve hit the road.

Conclusion

Commercial truck financing rates in 2025 continue to be influenced by credit scores, market conditions, truck type, and lender policies. For owner-operators, first-time buyers, and small fleets, understanding these factors is crucial to securing competitive interest rates and maintaining healthy business finances.

Mission Financial Services makes it easier for drivers and small fleets to secure the financing they need. Our goal is simple: help you keep moving, keep earning, and keep growing.

Don’t let financing hold you back. Start your credit application with Mission Financial Services today and get back on the road with confidence.